Cryptocurrency, spearheaded by the groundbreaking emergence of Bitcoin, has transformed the financial landscape. Bitcoin, with its decentralized nature and finite supply, served as a trailblazer, paving the way for a plethora of alternative digital currencies, collectively known as altcoins. In this article, we delve into the multifaceted world of cryptocurrencies, moving beyond Bitcoin to explore the diverse and dynamic ecosystem that has evolved over the years. Additionally, we’ll take a closer look at BC Game India, an anchor in the crypto space, and its role in shaping the industry.

Understanding Bitcoin

Bitcoin, introduced in 2009 by the pseudonymous Satoshi Nakamoto, brought decentralization and blockchain technology into the mainstream. Its decentralized ledger, the blockchain, ensures transparency and security in transactions. The limited supply of 21 million coins adds a deflationary aspect, contributing to its role as a store of value. However, Bitcoin faces challenges such as scalability issues and environmental concerns related to its energy-intensive mining process.

The Rise of Altcoins

While Bitcoin laid the foundation, altcoins emerged to address specific shortcomings and introduce innovative features. Ethereum, for instance, pioneered smart contracts, allowing programmable and self-executing agreements. Ripple focused on facilitating cross-border transactions, while Litecoin aimed for faster transaction confirmations through its Scrypt algorithm. These altcoins diversify the cryptocurrency market, catering to different needs and use cases.

Tokenization and its Impact

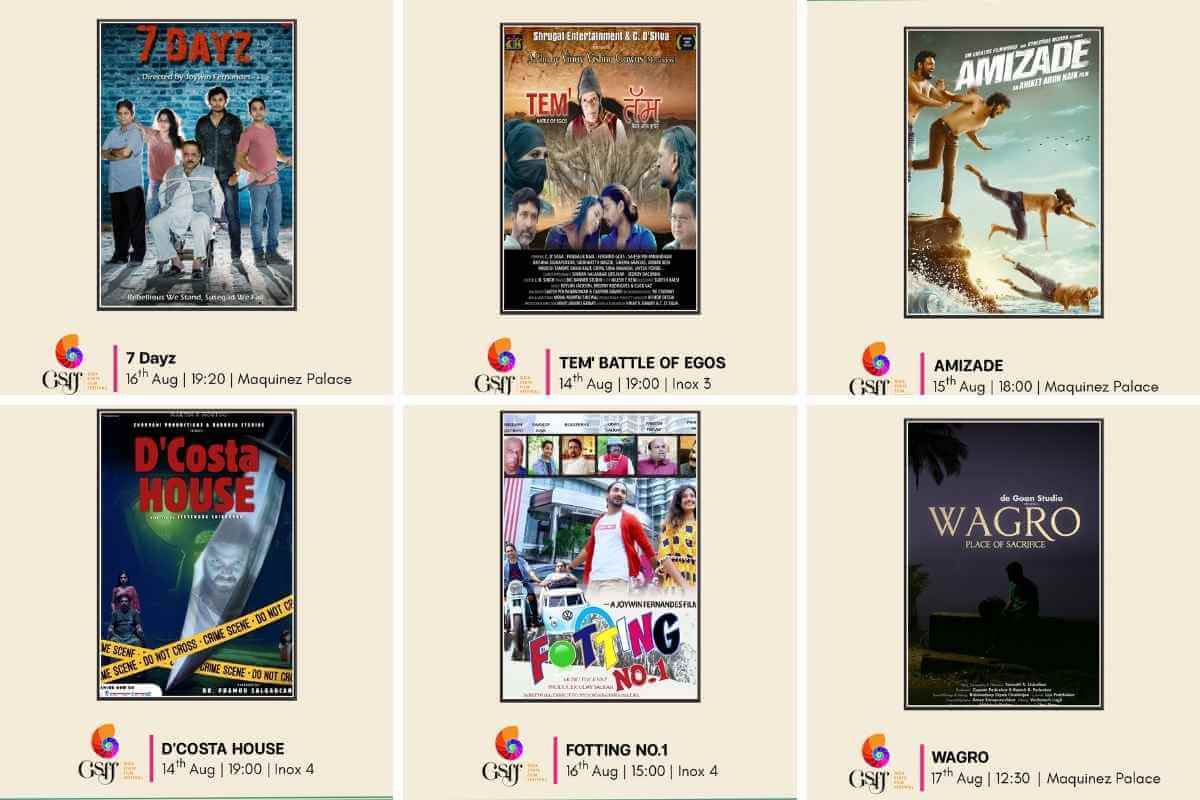

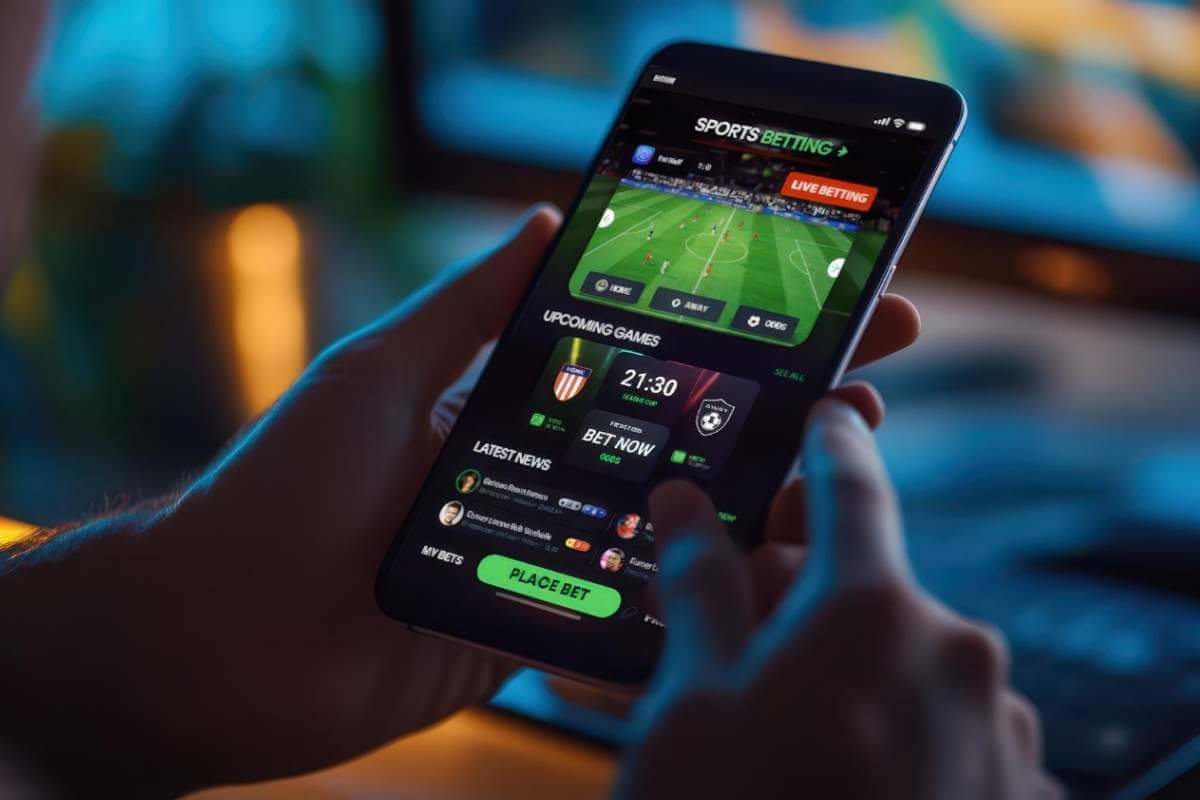

Tokenization, a concept gaining momentum, involves representing real-world assets as digital tokens on a blockchain. This process enables fractional ownership, increased liquidity, and seamless transfer of assets. Notable use cases include tokenized real estate, securities, and the booming market of non-fungible tokens (NFTs) representing unique digital assets like art and collectibles. Within this evolving landscape, BC Game online betting stands as a noteworthy example of tokenization applied to the dynamic world of online gaming and betting, demonstrating the versatility of this technology in various industries.

Types of Stablecoins

Stablecoins, designed to mitigate the volatility associated with cryptocurrencies, come in various forms:

- Fiat-collateralized: Tied to traditional currencies like USD or Euro, maintaining a 1:1 peg to ensure stability.

- Crypto-collateralized: Backed by other cryptocurrencies, providing stability through the collateralization of assets.

- Algorithmic stablecoins: Utilize algorithms and smart contracts to adjust the token supply dynamically, maintaining a stable value without direct backing.

Stablecoins: Bridging the Gap to Mainstream Adoption

Stablecoins have emerged as a crucial bridge between traditional finance and the cryptocurrency space. Their stable value makes them ideal for daily transactions, and they play a pivotal role in decentralized finance (DeFi) applications, contributing to the wider adoption of cryptocurrencies.

Privacy Coins: Balancing Privacy and Regulation

Privacy coins like Monero and Zcash prioritize user anonymity by employing advanced cryptographic techniques. However, the use of privacy coins has raised regulatory concerns, as they can potentially facilitate illicit activities. Striking a balance between privacy and compliance remains an ongoing challenge for these cryptocurrencies.

DeFi: Decentralized Finance

Decentralized Finance, or DeFi, represents a paradigm shift in traditional financial services. Built on blockchain technology, DeFi encompasses decentralized exchanges, lending and borrowing platforms, and automated market makers. While offering opportunities for financial inclusion, DeFi also introduces risks such as smart contract vulnerabilities and market volatility.

The Role of Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) represent the official digital form of a nation’s currency, issued and regulated by the central bank. The development and adoption of CBDCs hold implications for traditional banking, monetary policy, and the broader financial ecosystem. Several countries are actively exploring or piloting CBDCs to stay abreast of the

The cryptocurrency landscape extends far beyond Bitcoin, encompassing a diverse array of digital assets and technologies. From the rise of altcoins addressing specific needs to the transformative potential of DeFi and the ongoing exploration of CBDCs, the evolution continues. As the market matures, navigating risks and embracing innovation will be key to shaping the future of cryptocurrencies on a global scale. In this dynamic environment, BC Game promo and bonuses add another layer to the crypto experience, showcasing the industry’s adaptability and customer-centric approach to promotions and rewards within the gaming and betting space.